Memecoin has been all the rage in the

cryptocurrency world and stories only fuel the fire. Like the unexpected surge of

natural gas prices 75%, which is leading to financial impacts on other currencies such as Bitcoin. There was good news for

Ethereum, where

gas fees dropped 95% this year, even though the price of ETH also fell 53%.

The U.S regulator,

OCC, cleared up some issues about how banks can handle network gas fees, which ties to cryptos like

Ethereum and

GAS Coin. The idea of

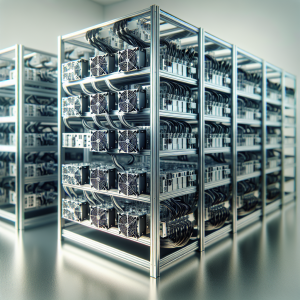

stranded gas has found purpose in powering block reward mining.

There are mentions of

Vitalik Buterin, creator of Ethereum, on his proposal to tackle Ethereum gas fees. This would involve a cap, aiming to control transaction costs. Interestingly, it appears there's a positive outlook for Ethereum, eyeballing a $3,500 price mark, following Vitalik's proposals.

In other territories,

Circle is launching its layer 1 blockchain named 'Arc', which will use the USDC stablecoin as its native gas token.

Tron saw a significant revenue drop following a gas fee reduction. However,

Ethereum seems to have taken a different direction where gas fees plummeted due to a decrease in activity, leading Ethereum to hit 60M gas limit before a planned upgrade.

There is talk of

Binance Coin (BNB) slashing its gas fee 2,000% which has caused a surge in gas fee prices due to high

meme coin activity. In terms of market projects, it's clear many are focusing on reducing gas fees and prioritizing memecoin transactions.

Lastly,

VISA is also experimenting ways to make Ethereum gas fees more accessible.

GAS Coin News Analytics from Mon, 07 Aug 2017 19:29:39 GMT to Tue, 20 Jan 2026 19:04:17 GMT -

Rating -3

- Innovation 5

- Information 8

- Rumor -2