Ethereum is making strides to increase its gas limit for enhanced scalability, with over fifty percent of validators supporting the move. Among recent developments, Bitdeer purchased a gas power plant in Canada for Bitcoin mining, while Justin Sun announced a gas-free stablecoin solution for both Tron and Ethereum chains, showing efforts to optimize transaction fees within the crypto space. An analysis of

GAS Coin indicates potential growth but underpins the importance of understanding gas fees and timing transactions when they are at their lowest.

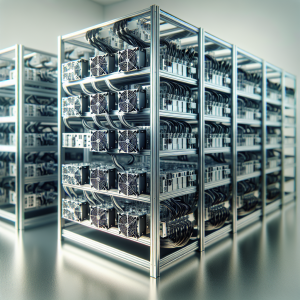

Cryptocurrency mining proves lucrative in rural Pennsylvania, where it offers a lifeline for dying gas wells. Raydium continues to dominate Solana DeFi, enjoying an 80% drop in gas fees as Meme Coin activity shifts. Energy from gas-flaring is increasingly seen as a profitable opportunity and doubling down on this, Petrobras and Argentinian energy companies are set to utilize oil gas for Bitcoin mining.

Despite gas fees soaring by 498% within a fortnight, Ethereum's median is at a five-year low. Efforts to reduce this further are underway with MetaMask rolling out a gas station feature and Vitalik Buterin proposing a total overhaul of Ethereum’s gas model. Ethereum's falling fees contrast with the increasing gas limit of the.

ETH network signaling bullish sentiment towards ETH. A major milestone is Ethereum's plan to migrate to layer-2 to slash fees and boost speeds, while Coinbase continues to enhance user experience with its own layer-2 offering.

However, the volatility in gas fees remains, with Ether's gas fees plummeting to less than 1 Gwei right after hitting an 8-month high. This volatility could possibly pose a challenge for the wide-scale adoption of GAS Coin and other such tokens.

GAS Coin News Analytics from Fri, 22 Jul 2022 07:00:00 GMT to Wed, 05 Feb 2025 11:24:51 GMT -

Rating -2

- Innovation 6

- Information 8

- Rumor -4