Various recent developments in the cryptocurrency sphere are bringing renewed attention to the concept of

'gas' in blockchain transactions.

Compass, in partnership with

360 Energy, has kickstarted a Bitcoin site in Wyoming powered by gas. Additionally,

Union Jack Oil is shifting from gas to Bitcoin, which is anticipated to boost crypto mining in the U.S. Further,

Ethereum co-founder Vitalik Buterin has proposed a transaction gas cap to enhance the security and stability of Ethereum. This proposal has triggered speculative

price fluctuations for Ethereum, garnering significant attention across industry observers.

Various

crypto wallet platforms are also integrating innovative solutions for gas.

D'CENT Wallet has launched

GasPass for enabling gas-free transactions, and

MetaMask plans to eventually end gas fees in its new roadmap. Meanwhile,

Circle has unveiled the Arc Blockchain, where

USDC operates as the native gas.

GAS Coin performance has also spiked after the Neo Bond Program, which feeds into rumors about a potential listing.

Gas fees also seem to have a significant impact on Ethereum's price, with recent statistics showing a

95% drop in average gas fees one year after the Dencun upgrade.

An increase in

meme coin activities seems to be driving up gas fees, with the BNB Chain reporting a

400% surge in such fees due to meme coin speculation. Lastly,

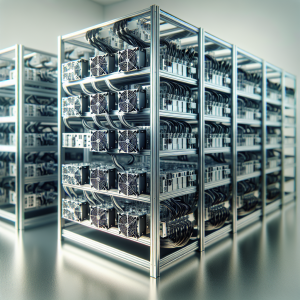

oil and gas companies are exploring partnerships with crypto miners to capitalize on the industry's growth, offering a fascinating blend of traditional and digital finance.

GAS Coin News Analytics from Mon, 07 Aug 2017 19:29:39 GMT to Mon, 29 Sep 2025 15:35:11 GMT -

Rating 3

- Innovation -1

- Information 5

- Rumor -7