Canaan, a bitcoin mining company, emerged as an innovative player in Canada by utilizing flared gas for computing power, an energy-saving method dramatically reducing carbon footprint. Meanwhile,

Ethereum looks into a proposal to enforce a gas cap on transactions to mitigate bloat. In another context, cryptocurrency enthusiasts are at the mercy of fluctuating gas fees, significantly affecting efficient transaction processing, particularly involving stablecoin usage and memecoin transactions. Notably,

Circle is working on a new blockchain, Arc, with USDC functioning as the native gas token. With gas fees being a pertinent issue, platforms like

BNB Chain have set up measures to cut fees, an appreciated measure as meme coin activity is leading to surging gas fees. Geologists and oil and gas industry professionals are flocking to crypto, notably with a rare $3.1 million coin discovered in a gas station, and companies like

AgriFORCE and

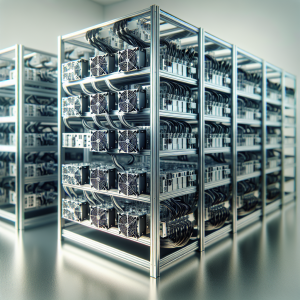

Bitdeer leveraging gas power for Bitcoin mining. Amid these developments, analysts observe a surge with Bitcoin's hash rate reaching an all-time high of 1,157 EH/s. The mining industry's landscape is fast evolving to include cryptocurrency. An example of this is

Union Jack Oil shifting to Bitcoin mining using gas. The trend extends beyond Bitcoin as various altcoins spike in popularity, such as the MNEE stablecoin and 'meme coins' which have gained notoriety in recent times. In terms of service, Ethereum gas fees dropped 95% within the past year owing to the Dencun upgrade, providing a much-needed break for users. However, Ethereum faced some negative impact with a 53% price fall since the upgrade. The crypto market remains volatile, with routine gas price updates aligning with wider global financial trends. Among novel initiatives, Ethereum's gas limit raised for the first time since 2021, thereby increasing its transaction capacity.

GAS Coin News Analytics from Mon, 07 Aug 2017 19:29:39 GMT to Tue, 21 Oct 2025 07:00:00 GMT -

Rating 7

- Innovation 8

- Information 6

- Rumor -2