Recent reports depict a volatile landscape for Ethereum gas fees, including a 498% increase over two weeks and reaching an 8-month high due to high network activity and a resurgence in memecoins. At the same time, gas fees dropped to a 5-year low due to significant adoption of layer-2 protocols such as Arbitrum and Polygon. Ethereum's co-founder, Vitalik Buterin, has suggested an overhaul of the gas model to address these fluctuations and improve scalability.

Several platforms including the Rabby Wallet, Raydium and Coinbase, are striving to mitigate gas fees or eliminate them entirely. Bitget has partnered with multiple projects for gas-free airdrops, setting precedence for other platforms to follow. Notably, USDC is looking at a role as a gas currency by going native on the Celo Blockchain.

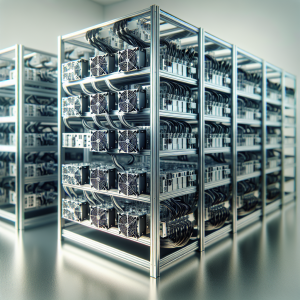

Simultaneously, bitcoin mining is gaining traction as an application for stranded natural gases. Notably, Argentinian energy company Tecpetrol and Genesis Digital Assets among others, have projects to mine bitcoins using stranded gas. This use of stranded gas for crypto mining, including the commitment from Iraq to capture flare gas, sparked speculation around this energy source.

Moreover, the DeFi sector is leading the pack in terms of fees generation on Ethereum, exemplifying the platform's versatile use cases. Other reports suggest uncertainty around Ethereum's upcoming Dencun upgrade and potential changes to Ethereum’s account abstraction.

GAS Coin News Analytics from Tue, 13 Mar 2018 09:18:12 GMT to Tue, 01 Oct 2024 10:46:52 GMT - Rating 5 - Innovation -3 - Information 8 - Rumor -2