Neo's price prediction for the next decade shows fluctuations, though overall bullish prospects. As cryptocurrencies continue to become more sophisticated, the focus has shifted to lowering

gas fees and enabling lower transaction fees, with numerous cryptos racing to achieve this milestone.

Ethereum's gas fees notably surged by 498%, but this was also met with a record drop, causing mixed reactions among users.

GAS Coin scored 16% as anticipated by analysts, while DeFi outperforms meme and stable coins in terms of fee generation.

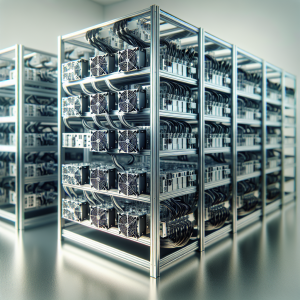

The Argentinian energy sector has seen a trend towards using excess gas to mine bitcoin, while various wallets and chains, including ERC-20 and Paymaster, are introducing support for diverse gas token options.

Vitalik Buterin's proposal for an Ethereum gas model overhaul and a record drop in Ethereum gas fees because of massive L2 adoption have sparked discussions about whether gas fees are too low or too high. Ethereum's gas fees continue to remain low, while a scientific paper argues that bitcoin mining could reduce methane emissions.

Gas fees increased to $140 with Babylon staking, but Ethereum saw a major drop in gas fees signaling a bullish trend for ETH. Meme coins have caused quite a sensation in the DeFi space, but their impact resulted in a surge in gas fees by 2000%.

Ethereum's plan to migrate to layer-2 aims to reduce gas fees, while other projects have unveiled gas-free solutions. Crypto Passive Earning and Zero Gas Tokens could disrupt the crypto space, and a drop in Ethereum fees could signal the start of an altseason.

GAS Coin News Analytics from Thu, 02 Nov 2023 07:00:00 GMT to Wed, 16 Oct 2024 13:16:29 GMT -

Rating 5

- Innovation -3

- Information 3

- Rumor -6