Recently, it came to light that the US is targeting $7.1M in digital assets from a fraudulent oil and gas operation. On the other hand, Ethereum validators are contemplating increasing the Gas Limit to 45M to accommodate a rise in transaction volumes, an initiative backed by vitalik Buterin's proposal for a 16.7M gas cap to enhance transaction efficiency.

Fleet owners have reportedly saved 18% through Gas Coin payment platforms, providing positive indications for the coin. Meanwhile, speculative whale activity points to Ethereum touching a $3,500 cap, triggered by the addition of a gas cap.

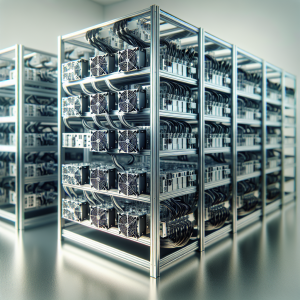

In terms of energy sourcing, the mining sector provides evidence of growing usage of natural gas, with Agriforce running 120 crypto miners on it. A remarkable event witnessed includes the tokenization of a $75M oil and gas deal in Latin America.

Meanwhile, within the Ethereum ecosystem, a significant decrease in average gas fees was recorded, year-on-year, around 95%, post the Dencun upgrade.

Lastly, the rise of meme coins has led to a drastic 400% surge in gas fees on the BNB Chain, leading to a significant update. Nevertheless, Ethereum is planning a 100x gas limit increase over the next four years, which could massively boost its transaction capacity.

GAS Coin News Analytics from Mon, 07 Aug 2017 19:29:39 GMT to Wed, 23 Jul 2025 06:36:03 GMT - Rating 3 - Innovation 4 - Information 5 - Rumor 6