Bitcoin is under consideration in significant ways with a White House report potentially acting as a catalyst. While the U.S. has no plans for a Bitcoin reserve, the digital asset report and Fed announcement are expected to cause price movements.

Fed rate decisions have already shown noticeable impacts on the market. However, some critique exists, with predictions of substantial losses for Bitcoin emerging. Meanwhile, companies, including

Twenty One, are increasing holdings, anticipating prices above $150,000. Despite some long-time holders selling off, several firms continue to expand their Bitcoin treasury, such as

Smarter Web Company and

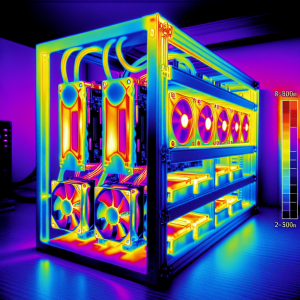

Bitcoin Miner MARA. There is a robust discourse around the future of a $10,000 investment in Bitcoin, showing both potential risks and rewards. Bitcoin's large-scale miners and treasury companies have offered contrasting perspectives on prospective price pressure. On the global stage, oil export increases are under discussion between Kazakhstan and Turkey through BTC while Canaan, a Bitcoin mining company, has adopted BTC as its primary reserve asset. In a changing market landscape, Bitcoin and other cryptocurrencies hover near their record highs, steadying as predictions for Fed rate holding grow. The power of Bitcoin speculators in dictating price targets is also highlighted.

These dynamics in Bitcoin, coupled with its adoption in crypto firms and the increasing interest from larger entities signal a still-evolving market.

BTC News Analytics from Thu, 24 Jul 2025 19:49:37 GMT to Wed, 30 Jul 2025 21:53:20 GMT -

Rating 3

- Innovation -3

- Information 4

- Rumor -2