Bitcoin's potential to reach a significant price of $200K by 2025, as suggested by Bernstein, has been the talk of the town. The crypto market, largely influenced by

Elon Musk's actions and comments, is expecting another massive movement tied to Tesla. The rise in

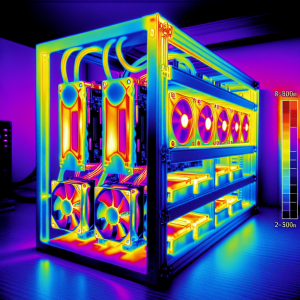

Bitcoin mining difficulty is currently at an all time high, signaling a possible upcoming bull run as

mining revenues increase. An astonishing $194 Billion of BTC is now held by bitcoin accumulation addresses, hinting at a swift and huge momentum for

BTC. Additionally, the mysterious bitcoin creator, Satoshi Nakamoto, has allegedly been unmasked as Peter Todd, causing a stir in the crypto world.

The market also sees a sizable bearish engulfing trend and spot ETF outflows boosting the odds of

Bitcoin falling to sub-$60K. However, bitcoin bulls are adamant, targeting a $90,000 price point. Bitcoin's flirt with the $70,000 mark following a hefty $2.4 Billion inflow into

ETFs suggests a possible breakout from the current

price range. The SEC has given a green light for options listing of three spot bitcoin ETFs to NYSE which could profoundly impact the market. Amid these fluctuations, Tesla continues to hold tight to its Bitcoin assets, reasserting its commitment to cryptocurrency despite the volatility. This eventful period for Bitcoin ends with a signal of a potential increase in short-term market volatility due to Bitcoin's $4.2B options expiration.

BTC News Analytics from Thu, 17 Oct 2024 11:25:44 GMT to Wed, 23 Oct 2024 20:54:22 GMT -

Rating 6

- Innovation 3

- Information 8

- Rumor -2