BlackRock is set to list a Bitcoin Exchange-Traded Product in Europe, another example of traditional funds finding ways to work with Bitcoin.

Trump's Tariffs have caused worries for a possible price crash for Bitcoin, Ethereum, XRP, and other cryptocurrencies.

MicroStrategy rebrands to Strategy, indicating further emphasis on its Bitcoin-based strategy, despite reporting its fourth quarterly loss.

Standard Chartered predicts Bitcoin to hit $500k by 2028 as ETFs become more easily accessible and its volatility decreases. However, concerns persist about whether Bitcoin has already peaked and about potential downside breaks of $90K-$110K.

Semler Scientific acquires 871 Bitcoin, while

Marathon Digital sees a drop in BTC production.

Strategy (formerly MicroStrategy) reports its Q4 GAAP loss while holding 471,107 tokens. The company emphasizes further commitment to Bitcoin by rebranding to its new name and adopting a Bitcoin-inspired logo. Recent worries over US-China tensions and Trump tariffs have led Bitcoin's price to dip, but a prediction of a 'Perfect Storm' taking Bitcoin to $500k remains.\n\n

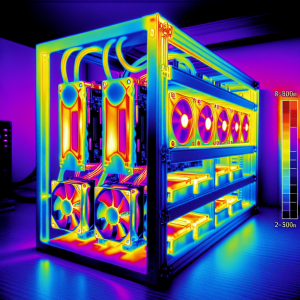

El Salvador continues to buy more Bitcoin, now holding 6,068 BTC in reserves. Meanwhile, the U.S. Sovereign Wealth Fund remains silent on the possibility of a Bitcoin Reserve. Bitcoin's price dropped to $98.5K, stalled below $100,000 despite praise from Trump's Crypto Czar, while Bitcoin's network hashrate growth was somewhat muted in January. Coin miners struggle with rising hashrate, leading to a drop in monthly Bitcoin production. Bitcoin funding rates turned negative for the 7th time in a year, with each previous drop eventually leading to gains. Amidst these fluctuations, the Bitcoin ETFs rebound after Trump paused tariffs on Mexico and Canada. While there is a sense of caution in the market, some experts feel that smart investors should invest in Bitcoin, not real estate.

BTC News Analytics from Fri, 31 Jan 2025 08:00:00 GMT to Wed, 05 Feb 2025 22:19:14 GMT -

Rating 0

- Innovation -3

- Information 4

- Rumor -2