Bitcoin has witnessed

wild fluctuations in recent times with price valuations hitting lows and highs between $70,000 and $83,500. The fluctuations are influenced by global market conditions, including tariffs, the performance of other cryptocurrencies, and sentiments from key figures in the crypto industry. Notably, the pause on Trump's tariffs led to a surge in

crypto prices, sending

Bitcoin up by 6% to $81,000. This event has inversely triggered bullish sentiments among pro

BTC traders. However, analysts like Michael Saylor predict that the

Bitcoin price could potentially slump, forcing a break in his promise to hold Bitcoin forever. Similarly, MicroStrategy expects a considerable loss due to the slump in Bitcoin's price. Several warnings of a devastating $10,000 price crash have emerged, further contributing to market volatility.Despite the turbulence,

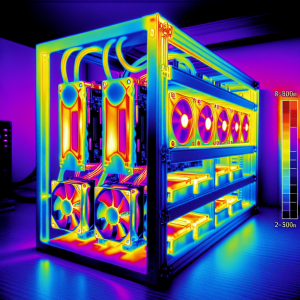

Bitcoin mining stocks have experienced a spike amid a historic market rebound. Top-ranking crypto entities have re-emphasized their support for

Bitcoin with several open-source tools for easier

Bitcoin treasury management recently launched by Block, a company owned by Jack Dorsey. At the same time, warnings about

Bitcoin becoming irrelevant if certain factors don't change have been issued. Lastly, companies like HEXminer continue to offer Bitcoin cloud mining platforms for daily passive income generation. Amid market volatility and various expert predictions, the fixed question remains on the potential low for

Bitcoin and whether the subsequent rebound will eventually hit a new high or subsequently slump.

BTC News Analytics from Fri, 04 Apr 2025 10:34:11 GMT to Wed, 09 Apr 2025 21:20:38 GMT -

Rating -2

- Innovation 2

- Information 5

- Rumor -3