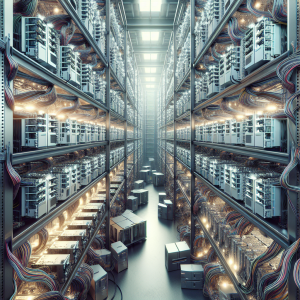

HIVE Digital, predominantly known as a Bitcoin miner, has made significant strides over the years. After completing their

first 100 MW facility in Paraguay, Hive also witnessed a

2% spike in their shares following the completion of their 100 MW site. It’s also strategically doubling down on its

Bitcoin hold strategy despite miner equity dilution and debt reliance, positioning them favorably in the ever-growing crypto market.

Hive also managed to kick off Bitcoin mining in Paraguay using

renewable energy, further emphasizing their commitment to sustainability. There were also notable deals such as acquiring a site from

Bitfarms for $85M, which allowed them to scale their operations by 400%. In addition, they’ve secured an order of 6500 Bitcoin miners from

Canaan, and continue to bolster their mining capacity.

Most intriguing is Hive’s decision to broaden its focus by venturing into AI data centers, a move that suggests the brand recognises the importance of diversification in an ever-evolving market. Hive contains high levels of Bitcoin, with

reserves growing 23% YoY. Furthermore, with the acquisition of Bitfarms, the firm aims to quadruple its Bitcoin mining capacity by late 2025.

Additionally, Hive Digital experienced a considerable boost in hashrate while minimizing costs per Bitcoin mined. Their shares have climbed by 11%, and they have reported 67% growth in their Bitcoin holdings. This underpins the fact that the brand is focused on growing its Bitcoin investment, reaching a 50% increase since 2023.

HIVE Coin News Analytics from Wed, 15 Nov 2017 08:00:00 GMT to Wed, 23 Apr 2025 17:35:09 GMT -

Rating 8

- Innovation 8

- Rumor -3